Identity Theft: It's NOT what you wanted for Christmas

The presents have all been opened, trash cans are burgeoning with holiday wrapping, ribbon, and packaging, and the family is enjoying a post-holiday glow - looking forward to New Year celebrations ahead. Unfortunately, if you have been the victim of identity theft, 2014 might not turn out to be the year you are hoping for.

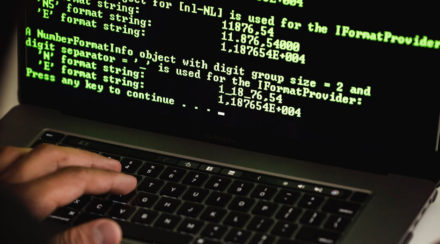

Situations like the Target credit card information debacle, combined with less-than-attentive credit card and shopping practices, may have left you exposed to identity theft.

While identity theft is a year-round risk, the holiday season increases your chances because shoppers tend to be more lax about shredding mail, keeping track of receipts and purchases, or meticulously monitoring their credit card and banking statements. Unfortunately, the ramifications of identity theft can be felt for years if the fallout is severe enough.

Tips for Avoiding Identity Theft During the Holidays

- Monitor statements. It can seem pretty tedious, especially if you went shopping crazy this holiday season, but it's imperative that you monitor your banking and credit card statements like a hawk. Research any debits that don't ring an immediate bill. Keep in mind that most identity thieves are savvy. They don't use your card to buy expensive items. Rather, they ring up smaller charges here and there that are less likely to be noticed. Often, these purchases take place at non-descript locations like gas stations and convenience stores. Plus, the sooner you notice fraudulent debits and charges, the sooner your bank or credit lender will be aware of it and can resolve the issue before hundreds - or thousands - are bled from your accounts.

- Be vigilant. In many cases, identity theft occurs during the holiday season but won't present a problem for months down the road. Don't stop checking your statements after January. Keep your eyes out for unusual activity year-round, but especially for the next several months. If someone has your credit card information, they may purposely wait a month or three before acting on it in the hopes you are less suspiscious once the holidays are over.

- Be online savvy. Never use your credit card on websites you are not familiar with, or your browser has already warned you about. You should never have to provide personal information such as your mother's maiden name, a social security number or a family member's birthdate. There are thousands upon thousands of viruses launched in the online and mobile gadget world, designed specifically to glean personal pieces of information that will be used against you later. If you feel something seems shady, questionable, or alarm bells are raised, do not continue to submit personal information. Find another site or call the company in person to do some research on your own before completing the sale.

- Be wary of "Amazing Deals". Think that flashy banner add or attractive website has deals that are "too good to be true?" They probably are. Hackers are expert at creating very reputable looking websites and pop-up ads that seem legitimate - but aren't. You are more likely to wind up paying for electronics and gadgets you never receive than getting the deal of a lifetime.

- Pay attention. Smart phones have made it easier for corrupt customer service representatives to take quick pictures of a customer's credit card. If you are checking out at a kiosk without a self-scanning device, keep your eyes on the card. Make sure it is within your vision at all times after you hand it over to the cashier so he or she is less likely to have a chance to copy it.

Need to begin an identity theft investigation?

If you suspect you are a victim of identity theft, contact Linked Investigations. We can begin an identity theft investigation, using online data searches and our investigative expertise, to help you take the actions necessary to mitigate the damage.